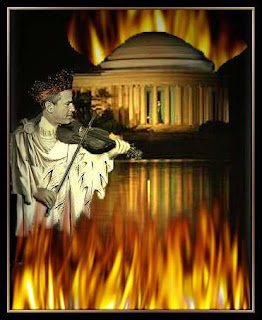

COULD THE BUSH RECESSION TURN INTO A BUSH DEPRESSION?

>

I don't know anyone who thinks we're not in a recession and I don't know anyone who says we're on the brink of a Depression. Most people have no reason to think we won't have a Depression; they just think "it can't happen here" or "now" or "to me." It shouldn't either. Nor should have George Bush. The most unlikely of morons to assume the presidency he's done everything that anyone could do to bring on a financial calamity. This morning's Paul Krugman column, Partying Like It's 1929, gets right to the point: right wing ideology is toxic. The "banking crisis of the 1930s showed that unregulated, unsupervised financial markets can all too easily suffer catastrophic failure." Krugman claims the hard-learned lessons were "forgotten" as the decades passed. I'm less generous.

To the laissez fairies of the extreme right Krugman's carefully regulated and supervised financial markets are communism. Anything that impedes absolute greed and selfishness in pursuit of the general good is treason. And along came Bush and his merry band of agenda-driven Mayberry Machiavellis.

Krugman is so logical and generous in his understanding of how markets work. I don't think he used the words "greed" or "selfishness" once in his column-- or even implied the base instincts behind them. But that is what has driven us to the brink of disaster-- and he knows it. He explains what made a garden variety recession of 1929 into the Great Depression of the 1930s and how society-- or at least the New Deal (imagine only 17 Republicans in the 1937 Senate)-- dealt with it. "And we all lived happily for a while-- but not for ever after."

Wall Street chafed at regulations that limited risk, but also limited potential profits. And little by little it wriggled free-- partly by persuading politicians to relax the rules, but mainly by creating a “shadow banking system” that relied on complex financial arrangements to bypass regulations designed to ensure that banking was safe.

For example, in the old system, savers had federally insured deposits in tightly regulated savings banks, and banks used that money to make home loans. Over time, however, this was partly replaced by a system in which savers put their money in funds that bought asset-backed commercial paper from special investment vehicles that bought collateralized debt obligations created from securitized mortgages-- with nary a regulator in sight.

As the years went by, the shadow banking system took over more and more of the banking business, because the unregulated players in this system seemed to offer better deals than conventional banks. Meanwhile, those who worried about the fact that this brave new world of finance lacked a safety net were dismissed as hopelessly old-fashioned.

In fact, however, we were partying like it was 1929-- and now it’s 1930.

The financial crisis currently under way is basically an updated version of the wave of bank runs that swept the nation three generations ago. People aren’t pulling cash out of banks to put it in their mattresses-- but they’re doing the modern equivalent, pulling their money out of the shadow banking system and putting it into Treasury bills. And the result, now as then, is a vicious circle of financial contraction.

Mr. Bernanke and his colleagues at the Fed are doing all they can to end that vicious circle. We can only hope that they succeed. Otherwise, the next few years will be very unpleasant-- not another Great Depression, hopefully, but surely the worst slump we’ve seen in decades.

Even if Mr. Bernanke pulls it off, however, this is no way to run an economy. It’s time to relearn the lessons of the 1930s, and get the financial system back under control.

Problem is there's another lesson Americans haven't learned-- or have forgotten. Calvin Coolidge is about to finish his second term, the worst presidency ever. And too many Americans seem more than willing to vote for Herbert Hoover.

Interestingly, this morning's Washington Post reports on the long overdue re-evaluation of the over-hyped Alan Greenspan, a kind of financial markets J. Edgar Hoover. "Perhaps," Steven Mufson's article begins, "the Maestro composed some discordant notes after all." Not that he gave two craps about the non-rich, but the Post also reports on how his policies are-- predictably-- hurting the poor and middle class hardest. "Inflation is walloping Americans with low and moderate incomes as the prices of staples have soared far faster than those of luxuries. Overall, inflation may only been up by 4% from last year, but for staples like groceries, gasoline, health care and other basics it's approaching 10%. That's real inflation that hurts people who live on budgets.

The record of longtime Federal Reserve chairman Alan Greenspan -- worshipped by business leaders and dubbed "Maestro" in a 2000 biography by the Post's Bob Woodward-- is getting a critical look as his successor Ben S. Bernanke wrestles with problems that began on the Maestro's watch.

Many economists blame Greenspan for lax bank supervision and for keeping interest rates too low, too long from mid-2003 to mid-2004. That, the theory goes, fueled the housing bubble and spawned subprime and adjustable-rate mortgages for low-income people, vast numbers of whom can't make their payments now. Banks bought those mortgages in bundles that are worth far less than they originally were. That has led to big write-offs, shaking the entire financial system.

And I don't think continuing Bush's economic policies-- as McCain has already been doing-- is going to help do anything to solve any of the problems... at least not for America. McCain and Bush seem to think exporting American jobs abroad is sound policy. They're incorrect-- although the French might disagree with me:

UPDATE: OLD LINE GREED & SELFISHNESS REACTIONARIES ARE TURNING ON BUSH BIG TIME

Steve Forbes is fuming at the ineptness of the Bush Regime's response to what he calls a financial panic. "Not since Jimmy Carter has the U.S. had a President so oblivious to the damage done by an increasingly feeble greenback."

The Bush administration must take two steps immediately to quickly halt the unending, enervating credit crisis: shore up the anemic dollar and, for the time being, suspend "marking to market" those new financial instruments, such as packages of subprime mortgages.

The weak dollar is pummeling equities, disrupting the economy, distorting global trade and giving hundreds of billions of dollars in windfall revenues--through skyrocketing commodity prices-- to our adversaries such as Iran and Venezuela.

...The Federal Reserve can rally the markets for a day or two by finding some new mechanism through which to lend more money to banks and other financial institutions. But this is the proverbial Band-Aid for a patient who is beginning to hemorrhage.

Labels: Alan Greenspan, Ben Bernanke, Bush recession, Bush Regime economic policies, inflation

2 Comments:

Till now, Bush has modelled himself on Lyndon Johnson---bullying the country into a quagmire.

He's realized just in time that historians don't approve of quagmires, so now he wants to model himself on Herbert Hoover.

Hi DWT - great article.

I would just like to nitpick for one second. I think you should run your articles through a grammar check, because your non-use of commas makes me re-read your sentences often. Just a friendly suggestion.

Post a Comment

<< Home