The Economy Has COVID-- But, Like Republican Governors, The Stock Market Is In A State Of Denial

>

Earlier this week, the National Bureau of Economic Research. declared that the U.S. is officially in a recession-- a GDP decline in back-to-back quarters. The stock market reacted by continuing a climb unhinged from any kind of economic reality. On Thursday, the markets finally seemed to get the message-- at least for the day-- as the Labor Department reported another 1.5 million American filed for unemployment benefits and Treasury yields dropped, the the benchmark 10-year Treasury note plunged 6 basis points to 0.681% and the 30-year bond fell 7 basis points to 1.440%.

Yesterday, reliable USA Today columnist Michael Linden wrote about the disconnect between the economy and the stock markets, Forget the stock market. In the real economy, there's coronavirus and mass unemployment., noting the insanity of the 30% increase in stock prices since the March lows.

Over the past two months, more than 37 million people have filed for unemployment and millions more have seen their hours cut (or have had to drop out of the workforce altogether). The unemployment rate in May for black people increased to 16.8%. Permanent job losses actually increased in May by almost 300,000, and since February, the economy has lost over 1 million permanent jobs. Some economists have estimated that the true overall unemployment rate for April was high as 34%. GDP-- while not the most complete or representative measure of the economy-- is expected to shrink as much as a cataclysmic 30% in the second quarter.

Frontline workers will tell you that they lack decent pay and safe working conditions. State and local governments are clamoring for resources as tax revenue dries up. The vast majority of small businesses have found themselves shut out of relief, for lack of an existing relationship with the big banks acting as the gatekeepers for loans. And millions upon millions of families are worried every night about how they will make it through the next day.

Clearly, for most people, the economy isn’t doing very well at all.

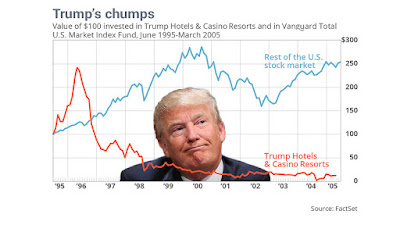

So, which is it? Is the stock market really the best assessment of the economy’s overall strength and potential, or is it fully divorced from the real economy that the vast majority of Americans experience day in and day out?

The stock market could hardly be a worse indicator for how the U.S. economy is actually doing. Focusing on the bottom lines of publicly-traded companies and the gross wealth hoarded by those at the top is not just an inaccurate way to measure our economy-- a fact that should be obvious at this point-- but it’s also a dangerous distraction from the steps the government must take to support the real economy: people.

To start, it’s helpful to examine who actually benefits from a strong stock market. The wealthiest 10% of Americans own 84% of stocks. Half of American families don’t have a penny invested in the stock market, and that includes 401Ks and other retirement savings. This is even lower among communities of color, with only 36% of Black families and 37% of Latin families owning stock.

Regardless of this shareholder breakdown, conservatives will say that high stock profits mean business executives can reinvest their gains into their workers. And yet, the wealth of billionaires in the U.S. increased by $282 billion in just three weeks when the market rallied in April-- even as 22 million people filed unemployment claims in that same time.

CEOs waxed poetic about the health and safety of their employees as they laid off thousands of workers, only to turn around and dole out hundreds of millions of dollars in dividends to their shareholders. Plain and simple, stock market increases and corporate bailouts further concentrate power and wealth into the hands of the few, away from workers and families.

Given that President Trump also stacked his “reopening the economy” council with dozens of Fortune 500 CEOs, it should come as no surprise that he and his allies in the Senate have primarily focused not on keeping people safe and providing relief, but on shielding companies from liability as they bring employees back to unsafe work conditions. The people closest to the Trump administration represent those who stand to gain the most from a booming stock market. It’s no wonder, then, that the president throws his weight behind policies expedient for the market and disastrous for millions of Americans’ health and stability.

The fallacy that financial markets are how to define economic success is exactly what got us where we are today: rampant inequality, a frayed safety net, and a middle-class teetering on the edge of disaster. It’s imperative that we correct decades of the conventional “wisdom” of what the economy needs, or what the economy is. Continuing to prioritize, even rely on, the reign of financial markets will not only not get us out of this-- it will leave us far worse off for the future.

Labels: COVID Economy, stock market, Trump economy, Trump Recession

2 Comments:

The markets have not been a valid measure of the proles' economy for 40 years.

It has never been a worse measure than it has been since the Clinton housing crash.

corporations and their stock owners have been backstopped and hoisted by 1 major factor since 1980 and a second one since 2008.

1) tax cuts that have NOT resulted in price reductions for goods, but rather a propensity to pay their boards a LOT more in compensation, much of it tied directly to stock performance rather than formerly accepted standards of performance, like various revenue or profit measures. The tax cuts since 2000 have largely enabled corporations to buy back their own issues in order to artificially buoy share price.

2) the fed. QE guaranteed shit bonds and derivitives to keep wall street balance sheets artificially black during the Clinton housing crash. A similar program to guarantee corporate bonds is being repeated. It started even before the pandemic hammered the economy. Very little has been reported about this latest round, the reasoning behind it and the future effects.

Basically what's been happening for 40 years is the government is creating money (and debt) to make and keep billionaires rich and to artificially keep corporate sheets in the black and stock prices artificially high.

Since 1980, this all has added up to 10s of trillions of dollars... borrowed from your childrens' and grandchildrens' futures to make the Walton family richer and to keep Jamie dimon in charge of the us economy.

The 99.99%? a few bucks here and there to convince all you morons that tax cuts are good/necessary/holy/godly. Since the pandemic? less than one tenth of one percent of the March $2.2 billion bill. and jack shit since.

upcoming (from both parties)? cuts to SSI, Medicare and Medicaid which both parties will convince you morons are necessary because of all that debt that they created with tax cuts and, somewhat, by the fed's years of QEs.

so elect your savior biden and the democrap fascists. better than the Nazis? not really.

That video is pure investor bullshit. Not once was it mentioned directly that the trillions going into the corporations have been used largely to buy back shares which boosts the share prices. Boost the share prices, and the indices go up. When the indicies go up, the corporate media boasts about how well the economy is doing,

And it's all one big lie.

How much ended up in YOUR wallet?

Post a Comment

<< Home