Trump And Ryan Scam America

>

“It’s not aimed at growth. It is not aimed at the middle class. It is at every turn carefully engineered to deliver a kiss to the donor class.”Ted Lieu's chief of staff, Marc Cevasco, wrote, as the Republicans were passing Trump's Tax Scam, "Well at least teachers can now write off private jets!" The Tax Scam is a gigantic and blatant ripoff of the working and middle class, an exercise of use the power gained through a fraudulent election to give billionaires money ripped out of the pockets of the working poor, students, and other among the most needy Americans, in an attempt to transfer the country's wealth upward to the donor class. And Trump himself would win big. Yesterday, Greg Sargent explained how Trump's betrayal of his base runs much deeper than just that. Señor Trumpanzee, he wrote, has been "amplifying one of his biggest lies: that he, personally, would lose out bigly under the plan. Post fact-checker Glenn Kessler has a new piece blowing up this falsehood. As Kessler shows, it’s likely that Trump and his family will save tens of millions of dollars, and quite possibly a lot more."

-Edward Kleinbard, formerly of the Congressional Joint Committee on Taxation

But this provides an occasion to reconsider just how much of a betrayal of Trump’s campaign promises this plan truly embodies, in a sense that goes well beyond his bottom line. That betrayal does not merely consist in Trump reversing course on his promise to help the middle class while sticking it to elites. No, the betrayal is more complicated, and runs much deeper, than that.

During the campaign, Trump told a story, mainly aimed at working-class whites in places that have gotten pulverized amid the globalizing economy and the brutal aftermath of a financial crash caused by reckless elite financial gamesmanship that left the top 1 percent relatively unscathed. That story went like this: I’m not like other politicians (Republicans included) or like other members of that financial elite. They have conspired with one another to fleece you blind. I got filthy rich milking the system. I will put my knowledge of how we elites engorged ourselves to work for you.

This is what Trump meant when he openly admitted during the campaign that “I fight very hard to pay as little tax as possible,” when he said that not paying income taxes “makes me smart,” and when he flatly declared that big donors “are in total control” of the presidential candidates, his GOP rivals included. “I was on the other side all my life and I’ve always made large contributions,” Trump said, “and I’m the only one up here that’s going to be able to fix that system.” In other words, people like me have gotten rich by buying the politicians and getting them to rig the system in our favor, and I have the inside knowledge of the scam to put things right.

Now Trump and the politicians, working together, are set to pass a tax plan that will lavish enormous benefits on people like Trump-- and in key ways further rigs the system on their behalf.

In a big speech [Thursday; see video up top] about the plan, Trump declared that “this is going to cost me a fortune” and added: “I have some very wealthy friends” who are “not so happy with me.” But as Kessler’s fact-check shows, this is nonsense. Both GOP plans repeal the estate tax or make the exemption vastly larger (which would benefit Trump’s family after he shuffles off to account for his life to his maker). They repeal the Alternative Minimum Tax, which is designed to ensure that the rich pay at least something. They both give preferential treatment to “pass-through” income, the vast bulk of which goes to the top 1 percent, and Trump owns an untold number of pass-throughs.

We don’t know precisely how the final plan would apply to him now, but this is because Trump has not released his tax returns (his argument is basically, “I’ll lose out bigly, believe me”). But based on 2005 Trump tax returns that have leaked, Kessler shows, under the plan Trump would have saved anywhere from $35 million to $42 million that year.

But this is not just about Trump. The Senate tax plan is basically a huge permanent corporate tax cut, tailored to fit within deficit and procedural constraints by setting the benefits for the working and middle class to expire, making it possible to pass entirely on party lines a large permanent tax cut overwhelmingly benefiting the top 1 percent, facilitated by a tax hike later for as many as 50 percent of less-fortunate taxpayers. This sort of legislative chicanery is, at bottom, just what Trump decried-- very wealthy donors benefiting from politicians cleverly gaming the system on their behalf. It’s the very scam Trump vowed to put to an end.

Meanwhile, Sen. Ron Johnson (R-Wis.) is demanding even more generous treatment of pass-through income. But as one tax analyst explains, this may encourage more wealthy people-- who are more prone to having the resources and know-how to work the tax system-- to reclassify their income as pass-through and lower their tax burden further. Both bills are meant to have safeguards against such gaming. But as Dylan Matthews points out, good lawyers are already hatching ways around this, meaning these new tax breaks “will create a big new loophole for the rich.” In other words, still more system-rigging.

In a sense, then, Trump’s claim that he-- and people like him-- will personally take a financial beating from this plan represents the culmination of the false story he made absolutely central to his campaign, and serves as a reminder of just how massive a betrayal of that story he and Republicans are now set to pull off.

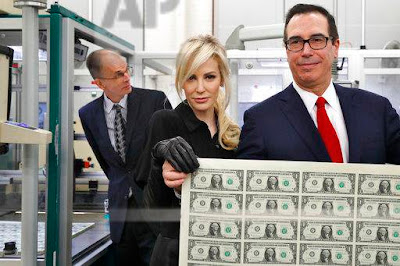

This helps explain why crooked Treasury Secretary Steven Mnuchin consistently lied his ass off about the "hundreds" of economists "working around the clock" to provide Congress (and voters) with an analysis of the wonders of the Tx Scam, proving beyond doubt it would pay for itself with explosive growth. It doesn't exists and the NY Times reported that an economist at the Office of Tax Analysis, on the condition of anonymity, said Treasury had no “dynamic” analysis showing that the tax plan would be paid for with economic growth because one wasn't even asked for.

Also at The Times James Stewart reported that Trump is flat out lying when he claims the tax bill doesn't benefit him personally. There are parts of the bill that "seem almost tailor-made," wrote Stewart, "to enrich the president and people like him."

“Commercial real estate came out essentially unscathed,” said Douglas Holtz-Eakin, president of the American Action Forum, a conservative advocacy group. Real estate developers “didn’t lose anything they care about,” and they got even more breaks, like a shorter depreciation schedule in the Senate tax bill, Mr. Holtz-Eakin pointed out.Jared Golden, the progressive running in Maine's second congressional district-- the seat held by Trump rubber stamp Bruce Poliquin-- has been a strong economic populist in the Maine House. Yesterday, while the Republicans were arguing about their Tax Scam catastrophe, he pointed out that "rising income inequity is straining life for working people all over the county. In my state, between 2012 and 2015, statewide, around 31% of real household income growth went to the wealthiest 5% of Maine households. For comparison, the poorest 25% saw just a 0.2% total income growth. [1] The effect of this is immense-- workers give up hope of getting ahead and exit the labor force, children live in poverty-- in my district over 21% of children below age 18 are living below the poverty level. And [2] What sort of a world are we leaving for our children and grandchildren when a small number of people earn more and more-- getting tax breaks and sweetheart deals, while children go hungry in the richest county in the world? The idea of the American Dream-- that you can get ahead with hard work-- is becoming more and more a work of fiction."

...“Lower pass-through rates and the repeal of the alternative minimum tax — those two alone are so hugely beneficial to Trump that I have trouble imagining any way that he wouldn’t come out ahead,” said Steve Wamhoff, senior fellow for federal tax policy at the nonpartisan Institute on Taxation and Economic Policy. (The pass-through reference involves income that typically comes from partnerships and limited liability companies.)

Not only that, but rental income, royalty payments and licensing fees-- some of the president’s major sources of income-- get especially favorable treatment under new rates for pass-through income. (Mr. Trump’s assets include more than 500 pass-through partnerships and limited liability companies.)

“Trump will make out like a bandit on all the big items,” said Steven M. Rosenthal, a senior fellow at the nonpartisan Tax Policy Center.

As many people have pointed out, the “wealthy and well connected,” as Mr. Trump described them, will benefit disproportionately from the proposed legislation. That’s in large part because the big tax cuts for corporations heavily favor shareholders, and the wealthy own a disproportionate amount of stocks and other assets.

...[T]he additional breaks that would benefit Mr. Trump and a small cadre of real estate developers like him stand out.

Consider one of the most criticized loopholes in the current tax code: the exemption from taxation of so-called like-kind exchanges. That has enabled owners of property to sell at a large capital gain but defer any tax as long as they use the proceeds to buy some other property.

The House and Senate bills eliminate the favored treatment of like-kind exchanges-- except for “real property.” Owners of paintings, for example, would not be able to sell a Cezanne and buy a Van Gogh tax-free. But owners of commercial real estate could keep flipping the properties until they die without ever paying any capital gains tax. (And if the estate tax is abolished, the gains might go untaxed forever.)

One of the biggest reforms in the tax legislation would limit the ability of businesses to deduct interest payments from their taxable income while giving them the ability to expense capital improvements (rather than depreciate them). Commercial real estate interests had howled over this provision, because they rely so heavily on debt to finance their operations.

As is the case with properties owned by most developers, Mr. Trump’s properties appear to be highly leveraged. While he has not disclosed his exact borrowings, he has called himself the “king of debt” and a New York Times investigation found that his companies had borrowed at least $650 million. Other estimates have gone above $1 billion. And, in another windfall for people like Mr. Trump, both the House and Senate bills exempt “any real property trade or business” from the limitation on deducting business interest.

The list goes on. In both the House and Senate legislation, only certain kinds of income are eligible for the lower pass-through rates. Short-term capital gains, dividends, interest and annuity payments do not qualify.

But rent, royalties and licensing fees-- all similar in character to the disallowed income-- weren’t included in that list, Mr. Rosenthal pointed out. All remain eligible for the lower pass-through rate.

“I call them the Donald J. Trump exceptions,” since the president receives so much income from those sources, Mr. Rosenthal said. “Trump will get a huge windfall on his rental, license and royalty income,” he predicted.

...One of the biggest benefits for the president, and for other wealthy taxpayers with high deductions, is the proposed repeal of the alternative minimum tax. Thanks to Mr. Trump’s leaked 2005 tax return, we know that the only reason he paid federal tax of 24 percent of his taxable income that year was because of the alternative minimum tax. (Without it, he would have paid just 4 percent.)

The rationale for eliminating the alternative minimum tax is that such a backup system should not be necessary if the tax code is fundamentally fair and eliminates all the loopholes that made it possible for high-income taxpayers to escape taxation in the first place. As should be obvious by now, this legislation expands such loopholes.

“It’s surprising to me that no real attempt was made to close any of these loopholes,” said Mr. Wamhoff, given that “virtually every nonpartisan tax expert agrees that commercial real estate is already so favored by the tax code.” Even Democrats, for the most part, have remained silent.

Perhaps it shouldn’t be so surprising, given that the president is the real-estate-investor-in-chief, and that his personal interests align with one of the country’s most powerful lobbies.

“Real estate interests are very powerful when it comes to the tax laws,” Mr. Holtz-Eakin said. “They’ve got bipartisan support, and it’s been that way forever.”

Labels: Greg Sargent, Holtz-Eakin, Jared Golden, tax policies

2 Comments:

The Oligarchy has successfully begun the process of restoring the legal ownership of humans in the USA.

In a nation this gawdawful stupid, it really isn't necessary any more to "scam" anyone.

The number of folks that can still discern truth from all the constant flotsam flying around is insufficient to even outvote the third who are white male and Nazi.

If we all moved to Cheyenne, we'd be unable to elect a decent mayor.

Face it folks (not for the lesser evilists who are plenty), we're just like kids in their booster seats... along for the ride.

Post a Comment

<< Home