Putin's Mad Pig Causes Stock Market Crash

>

Roland's still in his early 40's. I suggested he stay in the market and "ride it out," like I used to do. I'm older now and my riding days are done. I called my broker and told her to turn my stocks to cash. She reminded me I am still up for the year. I said "great... sell everything tomorrow, not at the opening but as soon as you see an opening that won't kill me." The market went down 4.6% yesterday. I see the correction more like 20-25%, unless Trump does something really insane. Then no one knows where the floor will be. Trump do something insane? Who could imagine that? Me-- and since Putin put him in the White House I kept telling myself, "Stop being a pig; pull your head out of the trough. You know what's going to happen. It's just a matter of time." I didn't and I did very well in that matter of time. In the end, I decided not to pull all my stocks out of stocks today, but did ask my broker to put together a play to further lighten up on stocks and increase my share in bonds as interest rates increase.

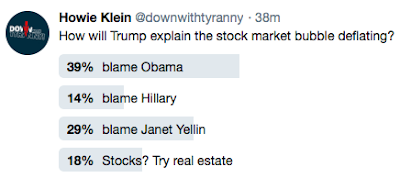

Trumpanzee should have kept Janet Yellin. Jerome Powell may want to emulate her but Jerome Powell doesn't know how. And she's for working families first and foremost. Do you think he is? Do you think anyone Trump appoints to anything is? Maybe we feel good that at least Trump didn't make Alex Jones chair of the Fed (at least not yet).

Every time he ran his fat mouth about how great "his" stock market was doing, I know he was tempting fate. I knew he was challenging the gods to bring it all crashing down on our heads. Maybe yesterday wasn't that. Or maybe it was. Or maybe it'll be next month or later. But one thing I know for sure. His economic policies are a one big ugly loser and he doesn't have a clue what he's doing-- or even understand he doesn't know he doesn't know what he's doing. After the close yesterday, Ben White noted that the repulsive, brainless slob had clearly set himself up. The always out for himself and only himself pig in the Oval Office "is learning," wrote White, "a basic and painful lesson of Wall Street: Stocks also go down... It was the largest ever single-day point drop for the Dow and it rattled both Wall Street and Washington, abruptly ending a remarkable period of placid markets where it often seemed the only direction was up. A young generation of Wall Street traders has never seen the kind of whipsaw action that seized markets Monday... It arrived amid growing concern that an economy juiced by a massive corporate tax cut, and already at full employment, could overheat and require forceful action from a new and untested Federal Reserve chairman-- installed by Trump-- to cool things down."

The country doesn't create any value anymore. Maybe he should have moved to do some of things he promised to do when he was campaigning-- like bringing back manufacturing for example? Putting a brake on mergers and monopolization? Instead, we have a mad orangutan threatening to shut down the government. How will the markets handle that?

Trumpanzee should have kept Janet Yellin. Jerome Powell may want to emulate her but Jerome Powell doesn't know how. And she's for working families first and foremost. Do you think he is? Do you think anyone Trump appoints to anything is? Maybe we feel good that at least Trump didn't make Alex Jones chair of the Fed (at least not yet).

Every time he ran his fat mouth about how great "his" stock market was doing, I know he was tempting fate. I knew he was challenging the gods to bring it all crashing down on our heads. Maybe yesterday wasn't that. Or maybe it was. Or maybe it'll be next month or later. But one thing I know for sure. His economic policies are a one big ugly loser and he doesn't have a clue what he's doing-- or even understand he doesn't know he doesn't know what he's doing. After the close yesterday, Ben White noted that the repulsive, brainless slob had clearly set himself up. The always out for himself and only himself pig in the Oval Office "is learning," wrote White, "a basic and painful lesson of Wall Street: Stocks also go down... It was the largest ever single-day point drop for the Dow and it rattled both Wall Street and Washington, abruptly ending a remarkable period of placid markets where it often seemed the only direction was up. A young generation of Wall Street traders has never seen the kind of whipsaw action that seized markets Monday... It arrived amid growing concern that an economy juiced by a massive corporate tax cut, and already at full employment, could overheat and require forceful action from a new and untested Federal Reserve chairman-- installed by Trump-- to cool things down."

On top of concerns about rising inflation, the tax cuts are already increasing the federal government’s need to borrow and accelerating the date by which Congress must raise the federal debt limit. And as of Monday, there was still no plan in Washington to raise the limit and avoid a catastrophic default.

The result is that a president who tossed aside traditional presidential caution in cheerleading the stock market now stands poised to take the blame for any correction.

“This is a risk that the president clearly set himself up for,” said Charles Gabriel of Capital Alpha Partners, a Washington research firm. “Until now, Trump’s had kind of a free ride in this market and taken so much credit for it, even though so much of it was due to easy-money policies from Janet Yellen and the Fed. Now she’s out the door and volatility is back.”

...[I]f the recent jump in hourly wages gets pushed up even more by corporations handing out bonuses and pay bumps in the wake of the tax bill, the Fed may be forced to move faster to fight inflation-- offsetting the economic benefits of the tax cuts.

Interest rates are already rising as the government discloses it will have to ramp up borrowing in 2018 to make up for revenue lost to the tax-cut bill. Higher rates on government bonds make stocks look less appealing. They also can make it harder for businesses and consumers to borrow and spend, possibly slowing the economy.

On top of all this, stocks blew past traditional valuations as they raced ahead in 2017 and early 2018. A widely followed ratio designed by economists Robert Shiller and John Campbell that compares stock prices to corporate earnings hit 34 this year. The historic median for the ratio is 16.

This could have served as a warning to Trump not to associate himself too closely with a rally that looked tenuous to many Wall Street analysts. Instead, Trump bragged about the gains at every opportunity on Twitter and even in his State of the Union address.

“The stock market has smashed one record after another, gaining $8 trillion in value,” Trump said in his address to Congress.

Last week’s decline alone wiped out nearly $1 trillion in that value, according to S&P Dow Jones Indices.

Trump has regularly boasted on Twitter that the stock market rise, which actually began in 2009 at the end of the last recession, is the direct result of his policies on taxes and regulation.

“Business is looking better than ever with business enthusiasm at record levels. Stock Market at an all-time high. That doesn't just happen!” he tweeted last August.

Other senior administration officials such as Treasury Secretary Steven Mnuchin and National Economic Council Director Gary Cohn have also tied the market’s gains directly to Trump policy moves.

The latest declines left a White House that has basked in the glow of the market rally scrambling to explain away the massive decline and calm frayed investor nerves.

“The President’s focus is on our long-term economic fundamentals, which remain exceptionally strong, with strengthening U.S. economic growth, historically low unemployment, and increasing wages for American workers," White House Press Secretary Sarah Huckabee Sanders said in a statement. "The President’s tax cuts and regulatory reforms will further enhance the U.S. economy and continue to increase prosperity for the American people.”

Stocks are still far higher than they were when Trump took office, but the return of sharp volatility-- and the possibility of further declines-- has now put Trump in the uncomfortable position of being directly associated with daily market moves.

“Presidents historically haven’t commented on the stock market anywhere near as much as President Trump has,” said Ed Yardeni, market analyst at Yardeni Research Inc. “I think Barack Obama said something in 2009 about how he thought stock prices seemed low, and that was about it. So he obviously likes to take credit for the positives. Now what does he say when the market suddenly goes down?”

...[S]ignificant risks lie ahead in Washington. The biggest is whether Powell and the Fed can navigate a difficult path between allowing the economy to thrive and wages to rise without letting potentially crushing inflation take hold. And if Powell and his colleagues decide they need to pump the brakes hard, that could leave them in direct conflict with a president not shy about criticizing people he himself put into office.

And it could leave Trump with regret about jettisoning a Fed chair whom Wall Street came to love. “For the past four years, Yellen was the fairy godmother of the bull market,” said Yardeni. “And now that she’s gone, maybe we don’t get the fairy dust anymore.”

The country doesn't create any value anymore. Maybe he should have moved to do some of things he promised to do when he was campaigning-- like bringing back manufacturing for example? Putting a brake on mergers and monopolization? Instead, we have a mad orangutan threatening to shut down the government. How will the markets handle that?

Labels: Trump's stock market crash

4 Comments:

This is why I put my money into owning my house free and clear rather than gamble in the markets with a 401k and die of starvation under a bridge.

I'd like the author to defend his statement that janet yellin is 'for working families'.

janet yellin did her job. she kept the seat warm and raised interest rates to help banks be more profitable. Her actions helped the exchanges too.

She didn't do shit for working families.

stocks have been overvalued for years, thanks to, among other things, all the untaxed money searching for somewhere to make more in a climate of near zero interest rates.

As the fed raises its rates and the rest of finance reacts, there will be volatility as money searches out the best possible resting places. As media hypes different reactions to the most recent tax moratorium and "imminent" fed interest rate raises, the markets will continue to react with more volatility.

There are 10s of trillions in loose, unproductive money searching for a nice return and every time the situation changes for any reason, the snow in the globe gets stirred up and starts settling again.

fear of inflation, not a 'thing' since poppy bush, is but one shake of the globe. Interest rates raising the value of bonds and like products will make some money move out of stocks. Artificial stock price goosing, which has been ongoing since the '90s with that little oopsie in 2008-2009 notwithstanding, is another probable result of the tax moratorium (as nontaxed corporations buy back more of their own issues) which may keep the stock money interested. Every time there is some kind of a scare or actual change, the markets lose their shit for a short time before leveling out again.

And all that doesn't even consider the times when collusion for political gain happens. I suspect the January swoon in 20016 was such a thing. Not that our revered government agencies would ever investigate such things. Not since 1979 anyway.

Just a thought him and Putin are manipulating the market. They are going to get rich. The U.S. is going to get robbed.

Post a Comment

<< Home