Bulletin: In the wake of the economic meltdown big-time policy mistakes were made! Paul Krugman reports from U.S. economists' annual confab

>

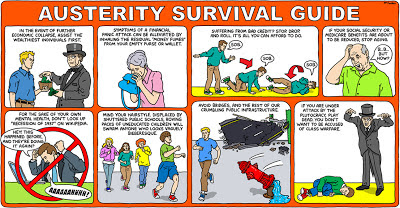

Brian McFadden (August 2011) [click to enlarge]

"A family can decide to spend less and try to earn more. But in the economy as a whole, spending and earning go together: my spending is your income; your spending is my income. If everyone tries to slash spending at the same time, incomes will fall -- and unemployment will soar."

-- Paul Krugman, in his NYT column "The Big Fail"

by Ken

Paul K, reporting from the annual meeting of the American Economic Association and affiliates in San Diego -- an affair he describes as "a sort of medieval fair that serves as a marketplace for bodies (newly minted Ph.D.'s in search of jobs), books and ideas" -- notes that, while in recent years "the ongoing economic crisis" has dominated discussion:

If you had polled the economists attending this meeting three years ago, most of them would surely have predicted that by now we'd be talking about how the great slump ended, not why it still continues.Of course this is a theme that Paul has been sounding regularly since the Bush and Obama administrations and Congress were thrashing out what the federal government's response to the economic meltdown would be. He bristles at the argument that "the economic failures of recent years prove that economists don't have the answers," insisting that, worse still, "in reality, standard economics offered good answers, but political leaders -- and all too many economists -- chose to forget or ignore what they should have known."

So what went wrong? The answer, mainly, is the triumph of bad ideas.

The story, at this point, is fairly straightforward. The financial crisis led, through several channels, to a sharp fall in private spending: residential investment plunged as the housing bubble burst; consumers began saving more as the illusory wealth created by the bubble vanished, while the mortgage debt remained. And this fall in private spending led, inevitably, to a global recession.As Paul has been writing since the immediate aftermath of the meltdown, this collapse was far too severe to be manageable by means, like lowering interest rates, that served in such lesser ones as the late='90s dot.com bust.

For an economy is not like a household. A family can decide to spend less and try to earn more. But in the economy as a whole, spending and earning go together: my spending is your income; your spending is my income. If everyone tries to slash spending at the same time, incomes will fall -- and unemployment will soar.

At that point governments needed to step in, spending to support their economies while the private sector regained its balance. And to some extent that did happen: revenue dropped sharply in the slump, but spending actually rose as programs like unemployment insurance expanded and temporary economic stimulus went into effect. Budget deficits rose, but this was actually a good thing, probably the most important reason we didn’t have a full replay of the Great Depression.But as we know, in Europe as well as the U.S., the crazy idea of "austerity" as a solution for recession or depression took hold.

Austerity became the order of the day, and supposed experts who should have known better cheered the process on, while the warnings of some (but not enough) economists that austerity would derail recovery were ignored. For example, the president of the European Central Bank confidently asserted that "the idea that austerity measures could trigger stagnation is incorrect."(What Paul doesn't point out this time out is a connection he has made frequently enough: that the most enthusiastic merchants of austerity, here and abroad, have been major financial players whose interest wasn't combatting the meltdown at all but using it as an opportunity to dramatically accelerate the transformation of the industrial world's economies to the latter-day "Rich Take All" format.)

Well, someone was incorrect, all right.

For Paul, the loudest splash in San Diego came from a paper by Olivier Blanchard and Daniel Leigh of the International Monetary Fund.

Formally, the paper represents the views only of the authors; but Mr. Blanchard, the I.M.F.'s chief economist, isn't an ordinary researcher, and the paper has been widely taken as a sign that the fund has had a major rethinking of economic policy.And "the really bad news," says Paul, "is how few other players are doing the same."

For what the paper concludes is not just that austerity has a depressing effect on weak economies, but that the adverse effect is much stronger than previously believed. The premature turn to austerity, it turns out, was a terrible mistake.

I've seen some reporting describing the paper as an admission from the I.M.F. that it doesn't know what it’s doing. That misses the point; the fund was actually less enthusiastic about austerity than other major players. To the extent that it says it was wrong, it's also saying that everyone else (except those skeptical economists) was even more wrong. And it deserves credit for being willing to rethink its position in the light of evidence.

European leaders, having created Depression-level suffering in debtor countries without restoring financial confidence, still insist that the answer is even more pain. The current British government, which killed a promising recovery by turning to austerity, completely refuses to consider the possibility that it made a mistake.

And here in America, Republicans insist that they'll use a confrontation over the debt ceiling -- a deeply illegitimate action in itself -- to demand spending cuts that would drive us back into recession.

The truth is that we've just experienced a colossal failure of economic policy -- and far too many of those responsible for that failure both retain power and refuse to learn from experience.

#

Labels: depression, economic meltdown, economic stimulus package, elites, IMF, Paul Krugman, recession

2 Comments:

This comment has been removed by the author.

Emotions and ideology are dominant over reason and evidence to the detriment of the economy. Some of the behavior is deliberate, because Americans' fear is perceived as an opportunity to enhance the advantage for the few.

Competitiveness without a moral foundation is destructive to society. One obvious problem is the willingness of professionals to be dishonest on many levels. BP engineers said that proper safety protocols were followed and that they were prepared for any contingency until they were not. Business leaders, politicians, scientists, economists and journalists are dishonest with their audiences most of the time. They are creating a nation built on sand.

The executive branch claims that military and intelligence advisers should lead when it comes to the conduct of war on foreign soil, but the truth is that civilian officials elected by the people establish the policies for the treatment of prisoners and other constitutional matters during a time of war.

A cowardly perception has consensus among American leaders who believe that the first priority is to protect American lives when the truth should be that the first priority is to protect the Constitution and the principles of a democratic republic. If lives are lost through standing on principle and loyalty to the rule of law so be it; fore these factors are components of bravery in a free society.

The freedoms protected by the Constitution are not a suicide pact, but they do sanctify the self-sacrifice of those who are loyal. How many modern leaders would say, "Give me liberty or give me death" and mean it? Far too many leaders are willing to deal with regard to founding principles.

Economics is not a science, because many of its practitioners are dishonest with their advice. Successful economists are those who sell whatever would be aristocrats want people to believe.

Post a Comment

<< Home